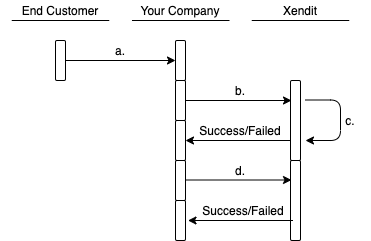

Product Flow

Remittance payout product flow are divided into 2 main flows:

- Create Remittance customers

The flow of Remittance customer creation can be found on the diagram above with on flow a. - c. , which explanation can be found below:- End-customer input sender, recipient and transaction details via your platform

- Your company trigger the request to Xendit to create customer data

- Xendit conducts KYC procedures, and creates remittance customers if the transactions pass our KYC checks

- Create Remittance transactions

After end-customers are created successfully, the next step is:- Your company triggers the request to Xendit to create Remittance transactions and Xendit will return a success response if the funds are remitted successfully to the beneficiary; otherwise, Xendit will return a failed response with a reason

Create Customer Interface

In the table below, you can find the functions of each feature

| Feature | Description |

|---|---|

| Create Remittance end-customers | End-customers are your customers. By using Xendit Endpoint, create the customers via API request. This includes the sender and recipient details of a remittance transaction. Xendit then will collects and stores end-customers’ identity data, such that the end-customer objects are reusable for future remittance transactions |

| Update your existing end-customers’ data via API request | This feature allows you to update by adding to existing information of your end-customers |

| Get detailed end-customers’ data with external_id | Get the existing end-customers’ data in detail by sending API request to Xendit using external_id. We will return the full details of your end-customers data that were previously created. Please note that this feature will return an empty array if there is no customer corresponding with the external_id |

Remittance Payout Interface

In the table below, you can find the functions of each feature

| Feature | Description |

|---|---|

| Create Remittance transactions from your Xendit Account on behalf of a sender to your designated recipient | You’ll need to have created a customer representing the sender and a customer representing the recipient first. After that in this feature, you'll be able to create the remittance transactions via API request by using Xendit endpoint |

| Get Remittance transactions with reference_id and remittance_id | Get the existing end-customers’ data in detail by sending API request to Xendit using either reference_id or remittance_id. We will return an array which contains the remittance corresponding to the unique id. Please note that we will return an empty array if there is no remittance transaction corresponding to the id |

After creating the Remittance transaction, we will send you a response containing the status of the Remittance transaction immediately. Responses from Xendit will be immediate information to your request and will explain whether your request is accepted or not to our side. For more information regarding our response statuses, you can go to this document.

Callback

After sending a response, we will send the callback via API to update the status of the transaction on each step of the process. You need to be able to accept our callback in order to get the callback status from us. Contact help@xendit.co or your Account manager to set up your callback URL.

Below are the callback status we send via API:

| Remittance Callback Status | Description |

|---|---|

| PENDING_COMPLIANCE_ASSESSMENT | Request is considered medium or high risk, and is being reviewed by our compliance team. Our team will contact you via email for extra information for enhanced due diligence. |

| COMPLIANCE_REJECTED | Request is rejected by our compliance team |

| SUCCEEDED | The sending bank has confirmed transmission of the remittance |

| FAILED | Remittance could not be transferred to the recipient due to certain errors. See Remittances Failure Codes |

| REVERSED | Only valid for SKN/RTGS and Cash Channel (in the future) use case |

Last Updated on 2024-10-23